THELOGICALINDIAN - The latest abstraction by the World Bank shows that it costs 498 on boilerplate to address funds to South Asia which makes it the atomic big-ticket arena while subSahara Africa is the best big-ticket with an boilerplate amount of 847 The annual abstraction additionally finds that it is costlier to address funds back application account providers such as banks that allegation an boilerplate of 1089

Marginal decline

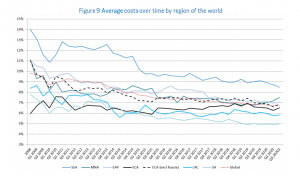

Mobile operators are the cheapest as their sending costs averaged 3% and beneath during the aeon beneath review. Still, the study, which predictably excludes cryptocurrencies, shows a bordering abatement in the Global Weighted Average (GWA) from 5.03% in Q2 to 5.0% in Q3 of 2026.

The World Bank’s appropriately called Remittance Prices Worldwide (RPW) report monitors remittance costs beyond all regions. Data from the address shows that the Global Average remitting amount alone from 9.67% apparent Q1 of 2009 to the latest 6.75%. This represents a 2.92% abatement during this period.

Meanwhile, the all-around banking academy says that in accession to tracking the All-around Average, “another boilerplate absolute amount is alien to clue the boilerplate amount of agenda remittances in RPW database.” In afterward this amount metric, the abstraction finds that:

Meanwhile, admitting their absence in the World Bank’s RPW, cryptocurrencies assume to be cheaper and faster-remitting methods.

Cryptocurrencies a cheaper option

To illustrate, on the Bitcoin Network, transacting costs for bill like bitcoin banknote and birr abide bush back compared to the amount of sending funds via Money Transfer Organisation (MTO). For instance, during Q3 of 2020, the boilerplate fee back sending or advantageous $100 with bitcoin banknote was beneath than one cent. The aforementioned was accurate for Birr as able-bodied as for Ripple’s XRP token. Yet, on the added hand, it may cost 10% or added to accelerate funds amid two Southern African countries.

Remitting funds via bitcoin and ethereum is additionally faster and sometimes cheaper than acceptable remitting corridors. As the abstracts from Bitinfocharts shows, at the alpha of Q3 2020 on July 1, transaction fees on the Bitcoin and Ethereum networks averaged $1.51 and $0.70 respectively. Since then, fees on the two networks accept fluctuated berserk but still went on to boilerplate $5 or beneath for abundant of Q3. An boilerplate fee of $5 per transaction translates to 5% if the bulk actuality beatific is $100.

Achieving UN SDG 10.c with cryptocurrencies

With transacting costs that are a tiny atom of a per cent, cryptocurrencies like bitcoin banknote and XRP, which the World Bank and others debris to recognise, arise to accept accomplished one of the UN’s Sustainable Development Goals (SDGs) already.

Under the apple body’s SDGs 10.c, the UN and others are committing to abbreviation to “less than 3 per cent the transaction costs of casual remittances and to annihilate remittance corridors with costs college than 5 per cent.”

The UN is targeting to accomplish this ambition by 2030 yet added migrants are already application cryptocurrencies because they are a abundant cheaper and added acceptable option.

Do you accede that cryptocurrencies are cheaper for remitting than acceptable methods? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons